Auto Insurance

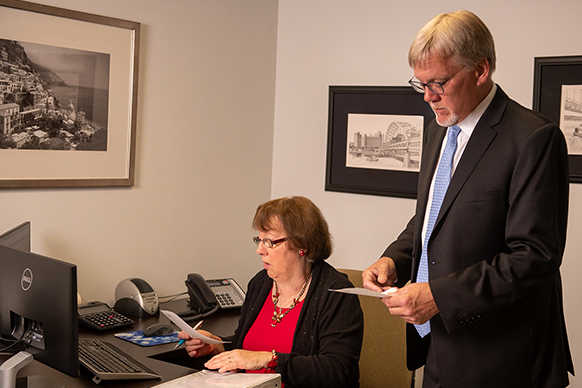

According to Pennsylvania’s DMV, there are over 9 million licensed drivers in the state. With this massive number, you are bound to meet uninsured motorists, drunk ones, and those that text while driving. And because you can’t control irresponsible behavior on the roads, you need auto insurance from Tommelleo & Associates to protect you and your vehicle.

Why you need auto insurance

If a federal-registered lender finances your vehicle, they require you to carry auto insurance as long as the loan facility is outstanding. The Keystone State also requires all drivers to have the below minimum auto insurance coverage:

- Liability coverage: Bodily injury liability protects you when you are at fault and cause bodily injury to other persons. The state requires you to carry a minimum of $15,000 for an accident involving one person and $30,000 for multiple persons. Property damage liability covers damages caused to third parties. The state requires you to carry a minimum of $5,000 per accident.

- Medical payments: Covers medical and funeral costs for you and your passengers in case of a vehicular accident. The minimum requirement is $5,000.

Other car insurance options

At Tommelleo & Associates, we advise our clients that it’s essential to carry the state-required auto insurance, but it isn’t enough. For optimal coverage, you need to consider the below options:

- Collision coverage: To pay for damages or replace your vehicle when involved in an accident.

- Comprehensive coverage: To protect your vehicle from non-collision perils like fire, theft, vandalism, storms, and many more.

- Uninsured/underinsured motorist cover: To protect you in hit-and-run incidents as well as when you collide with a motorist with insufficient or no auto insurance.

What determines your auto insurance rate?

Having a poor credit rating will hit hard on your auto insurance rate. Again, adding a teen driver to your policy and poor driving record will add a few hundred dollars to your auto insurance rate. Other factors that may affect your auto insurance premium include:

- Occupation

- Gender

- Zipcode

- Car model and value

- Add-ons on your auto insurance

Do you need auto insurance? At Tommelleo & Associates, we understand that every driver’s auto insurance needs are unique. As such, we offer customized auto insurance plans to fit your individual needs.